From a broad perspective, the Go To Market plan is a touchstone document that starts as a draft and goes through revisions until sign off by all associate parties is achieved, at which point it is locked down. Further revision is possible, but would need to go through an additional draft/sign off procedure. In most instances in the tech and online world this document aligns senior management, sales, product marketing, marketing and product management. The document should go from overview (strategic) to specific (tactical/executional) as this aids senior management who may be more inclined to make sure the strategy is aligned with their vision without forcing them to sift through the detail. Here are the sections I like to include, yours may vary. This scenario is an online advertising network looking to get into real time bidding.

Executive Summary

Here is where we outline the strategy and general time frame for the major deliverables and launch. If it is a small release then the audience may be a VP or Director, big releases the audience would be VP or CEO level. The strategy documentation is best developed by a top down approach, so if you can get access to that thinking, use it and infuse that strategy throughout the plan. You may want to get buy in on this section before digging into the other sections.

Here is a example of a phase/product dev objective/strategy matrix that could be used in this section:

How and when revenue will be delivered by the release. What value does it add to the org? Outline here any potential cannibalization issues. This section should contain a summary and a standard projection spreadsheet.

Competitive Landscape

Who is currently in this market and how will this release provide competitive advantage? If this is a first to market product, what are the time and impact expectations from the other industry players?

Perspectives Matrix

This is something I created as an exerise that I found useful. It is a conceptual diagram that relates changing perspectives of multiple entities over time. I like it for understanding the perspectives of product marketing, product management and Customers. (note on my nomenclature, I use big C for external customers, little c for internal customer for whom I provide deliverables.)

I like this exercise because it forces you to step out of the product marketing role and think of the other critical partners for the successful adoption of the release. Here is an example:

Timelines

We are now starting to shift to the tactical. Timelines (a.k.a. time tubes or swim lanes) align the various groups around the major dates of deliverables. You should be meeting with product management and sales to provide input for this section.

Here is an example of two swim lanes, one for product management and one for engineering. In a GTM plan you would have the product management timeline and a product marketing timeline. Notice that the timelines are referencing the phases outlined in the executive summary section. This is an example of how we are infusing the strategy throughout the plan:

RASCI Matrix

For me the RASCI Matrix is the crux of the plan. Nothing gets done without the buy in and sign off from the different functional groups within the org. It aligns everyone to the same plan and assigns accountabilites. If you can create a very detailed RASCI Matrix and get sign off, then congratulations! you just may have a shot of getting the product released on time and with impact.

Here is an example of a RASCI Matrix:

SWOTS Analysis

This is a good exercise, mostly it's for the benefit of the product marketing team, but one of our responsibilities as product marketers is educating the other teams and this matrix when shared can provide a good snapshot of current state.

Messaging Framework

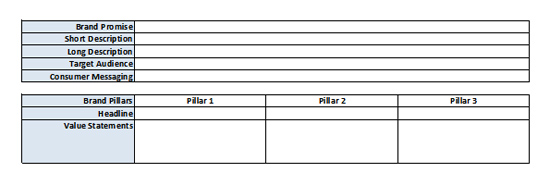

This is the last section (although I generally do an extensive appendix with competitive landcape information culled from press releases and news.) The messaging framework will supply the marketing collateral with information developed by product marketing during the go to market process. It is checked against the executive summary and (via meeting with product management) what is actually being released to ensure the strategy is consistent and in alignment with the final product. It summarizes the positioning of the product, the target audience, current perceptions, customer issues, points of differentiation, specific messaging, tone and the value pillars that hold up the solution promise made to the Customer. It is in two sections, with the top section containing the overview messaging and the bottom section containing the main brand/product pillars with their associated value statements. The value statements when possible should use the A.R.E. approach (assertion, reasoning, evidence) Three pillars each with three value statements is usually enough info (with a little left over) for the press release and a one-sheet.

Various versions exist, but here is a diagram of the general structure: